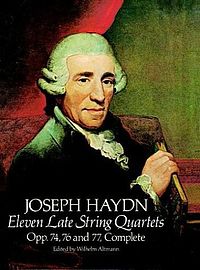

Eleven Late String Quartets, Opp. 74, 76 and 77, Complete pdf mobi txt 2024 电子版 下载

Eleven Late String Quartets, Opp. 74, 76 and 77, Complete电子书下载地址

- 文件名

- [epub 下载] Eleven Late String Quartets, Opp. 74, 76 and 77, Complete epub格式电子书

- [azw3 下载] Eleven Late String Quartets, Opp. 74, 76 and 77, Complete azw3格式电子书

- [pdf 下载] Eleven Late String Quartets, Opp. 74, 76 and 77, Complete pdf格式电子书

- [txt 下载] Eleven Late String Quartets, Opp. 74, 76 and 77, Complete txt格式电子书

- [mobi 下载] Eleven Late String Quartets, Opp. 74, 76 and 77, Complete mobi格式电子书

- [word 下载] Eleven Late String Quartets, Opp. 74, 76 and 77, Complete word格式电子书

- [kindle 下载] Eleven Late String Quartets, Opp. 74, 76 and 77, Complete kindle格式电子书

内容简介:

This volume includes 11 string quartets in complete score — Haydn's last and best.Reprinted from the reliable modern Eulenburg edition.

书籍目录:

暂无相关目录,正在全力查找中!

作者介绍:

暂无相关内容,正在全力查找中

出版社信息:

暂无出版社相关信息,正在全力查找中!

书籍摘录:

暂无相关书籍摘录,正在全力查找中!

在线阅读/听书/购买/PDF下载地址:

原文赏析:

暂无原文赏析,正在全力查找中!

其它内容:

书籍介绍

This volume includes 11 string quartets in complete score — Haydn's last and best.Reprinted from the reliable modern Eulenburg edition.

精彩短评:

作者:ntxz 发布时间:2011-10-08 18:56:11

这个比演义好看多了

作者:阅微草堂 发布时间:2012-12-11 01:44:41

干巴巴的像大便。。你读过以后,你可以知道一些名词的意义,但是你不会理解。。。

因为,你不知道那几个人:亚里士多德(主词量化,形式逻辑),布尔(谓词量化),弗雷格(引入函数,谓词逻辑),康托尔(无穷,序(良序,偏序,全序)和基数),乔姆斯基(形式语言和自动机,引入泛函),图灵(可计算---推理====估计)

作者:廖凌云 发布时间:2024-01-18 21:48:29

最喜欢猫婆

作者:Wishbao 发布时间:2013-07-24 10:53:43

爱人

作者:莉水小刀 发布时间:2020-06-29 18:16:59

挺有趣的,虽然跟哈佛没关系是肯定的

作者:schwimmer 发布时间:2013-09-26 09:35:02

一直记得运用如尼魔文

深度书评:

2018年春季罗伯特·希勒《金融市场》课程大纲、阅读材料

作者:张宇涵 发布时间:2018-01-28 14:08:00

这是入门级的概论课。如果你有一点金融基础,就不必看了。

我记的课堂笔记整理在这里:

1-7课

,

8-14课

,

15-23课(完)

我收集的书目:

金融通识 Finance for Liberal Arts

Course Description:

Financial institutions are a pillar of civilized society, directing resources across space and time to their best uses, supporting and incentivizing people in their productive ventures, and managing the economic risks they take on. The workings of these institutions are important to comprehend if we are to predict their actions today and their evolution in the coming information age. The course strives to offer understanding of the theory of finance and its relation to the history, the strengths and imperfections of such institutions as banking, insurance, securities, futures, and other derivatives markets, the problems and crises with these institutions, the moral issues that financial practitioners face, and the future of these institutions over the next century.

Books to Purchase:

Frank J. Fabozzi,

Capital Markets: Institutions, Instruments, and Risk Management

, 5th ed., Cambridge: MIT Press, 2015.

Robert J. Shiller,

Irrational Exuberance 3rd ed

, Princeton University Press, 2015.

Lectures and Readings (* denotes optional reading; if a book, on reserve at Bass Library)

Lecture 1: Introduction: Finance and Our Human Purposes

Wed, Jan. 17

Fabozzi, Ch. 1, Financial Assets and Financial Markets, Ch. 2, Overview of Risks and Risk Management, Ch. 3, Overview of Market Participants

Shiller,

Finance and the Good Society

, Princeton University Press, 2012,

Introduction

Carnegie, Andrew,

The Gospel of Wealth and Other Timely Essays

, New York: The Century Company, 1901, Ch 1, pp. 1-46 (

Excerpts in Carnegie’s voice in 1914 Thomas Edison audio file

click on “web exclusive audio” below)

*“

The Gospel of Wealth

” (Review)

San Francisco

Chronicle

, February 9, 1890, p. 4.

*Surowiecki, James, “In Defense of Philanthrocapitalism,”

The New Yorker

, Dec 21 & 28, 2015, p. 40.

Lecture 2: Risk and Entrepreneurism and Financial Crises

Fri, Jan. 19

Goetzmann,

Money Changes Everything,

Introduction

*Gary Gorton, “

Slapped in the Face by the Invisible Hand: Banking and the Panic of 2007

,

”

Federal Reserve Bank of Atlanta Financial Markets Conference, 2009

Lecture 3: Insurance

Mon, Jan 29

Fabozzi, Ch. 5, Insurance Companies, pp 141-159

*Michel-Kerjan, Erwann O., Paul A. Raschky and Howard Kunreuther,

“Do Firms Manage Catastrophe and Non-Catastrophe Risks Differently?”

University of Pennsylvania, Wharton School Working Paper

Lecture 4: Portfolio Diversification, CAPM & Supporting Financial Institutions

Wed, Jan 31

Fabozzi, Ch. 13 “Portfolio Selection Theory,” Ch. 14 “Asset Pricing Theory”

*Jeremy Siegel,

Stocks for the Long Run

, Chapters 1 and 2, Reserve, Bass

Lecture 5: Technology and Invention in Finance

Mon, Feb 5

Shiller, Robert J., “

Crisis and Innovation,

”

Journal of Portfolio Management,

2010.

*Georgia Levenson Keohane,

Capital and the Common Good: How Innovative Finance is Tackling the World’s Most Urgent Problems

, Columbia Business School Publishing, Columbia University Press, 2016

*Sandor, Richard L., Good Derivatives:

A Story of Financial and Environmental Innovation

, Wiley, 2012

Lecture 6: Efficient Markets

Wed, Feb 7

Shiller,

Irrational Exuberance,

Appendix, "Nobel Prize Lecture: Speculative Asset Prices, pp. 239-42 only, Ch. 9 "Psychological Anchors for the Market," "Ch. 10: Herd Behavior and Epidemics"

Fabozzi, pp. 259-62

Conant, Charles A.

Wall Street and the Country: A Study of Recent Financial Tendencies

, New York, G.P. Putnam’s Sons, 1904, Ch. 3, The Function of the Stock and Produce Exchanges, pp. 83-116

*Lehrer, Jonah, “

The Truth Wears Off: Is there Something Wrong with the Scientific Method

?”

The New Yorker

, December 13, 2010, pp 52-57.

*Swensen, David,

Pioneering Portfolio Management

, Ch. 8, Alternative Asset Classes (Reserve Bass)

Lecture 7: Behavioral Finance and the Role of Psychology

Fri, Feb 9

Shiller,

Irrational Exuberance

, Ch. 11, "Efficient Markets, Random Walks, and Bubbles," and Ch. 12 "Investor Learning--and Unlearning”

Shiller, “

From Efficient Markets to Behavioral Finance

” Journal of Economic Perspectives, 2003

Lecture 8: GUEST LECTURER: DAVID SWENSEN

Wed, Feb. 14

Fabrikant, Geraldine, “

The Money Management Gospel of Yale’s Endowment Guru

”,

The New York Times,

Nov. 5, 2016

*Swensen, David: "Pioneering Portfolio Management"

Introduction

Lecture 9: Theory of Debt, Its Proper Role, Leverage Cycles

Mon, Feb 19

Shiller,

Irrational Exuberance

, Ch. 2, "The Bond Market in Historical Perspective"

Fabozzi, Ch. 15 “The Theory and Structure of Interest Rates;” Ch 16 “Valuation of Debt; Ch 17 “The Term Structure of Interest Rates”

* Sullivan, Teresa, Elizabeth Warren and Jay Lawrence Westbrook,

The Fragile Middle Class: Americans in Debt

, Yale University Press, 2000.

Lecture 10: GUEST LECTURER:

Georgia Levenson Keohane,

Wed, Feb. 21

Executive Director, Pershing Square Foundation

*Keohane, "Capital and the Common Good,"

Introduction

Lecture 11: Corporate Stocks

Fri, Feb. 23

Fabozzi, Ch 18 “The Structure of the Common Stock Market”

Shiller,

Irrational Exuberance

, Ch. 1, The Stock Market in Historical Perspective; and Appendix, Nobel Prize Lecture, Speculative Asset Prices, pp. 243-58.

Lecture 12: Real Estate

Mon, Feb. 26

Fabozzi, Ch. 25 “The Residential Mortgage Market”; Ch. 26 “The Market for U.S. Agency Residential Mortgage-Backed Securities”

Foote, Christopher, Kristopher S. Gerardi and Paul S. Willen, “

Why Did So Many People Make So Many Ex Post Bad Decisions? The Causes of the Foreclosure Crisis

,” Federal Reserve Bank of Boston, 2012.

Shiller,

Irrational Exuberance

, Ch. 3, The Real Estate Market in Historical Perspective

Lecture 13: Misbehavior, Crises, Regulation and Self-Regulation

Wed, Feb 28

*Johnson, Simon, Rafael La Porta, Florencio Lopez-di-Silanos, and Andrei Shleifer,

"Tunneling,"

American Economic Review,

2000, 90(2):22-7. (JSTOR)

Lecture 14: Banks

Mon, Mar 5

Fabozzi, Ch. 4 “Depository Institutions”

*Scott, Kenneth, “

Dodd-Frank: Resolution or Expropriation

?” Hoover Institution, Stanford University, 2012.

Lecture 15: Forward and Futures Markets

Mon, Mar 26

Fabozzi, Ch 9, “Introduction to Linear Payoff Derivatives: Futures, Forwards and Swaps”

“

A Long Road to Regulating Derivatives

,”

The New York Times

, March 24, 2012.

*Working, Holbrook,

"Futures Trading and Hedging,"

American Economic Review

, June 1953, pp. 314-43. Reprinted in

Selected Writings of Holbrook Working

. (JSTOR)

*Melamed, Leo,

For Crying Out Loud: From Open Outcry to the Electronic Screen,

Wiley, 2009.

Lecture 16: Monetary Policy

Wed, Mar 28

*Walter Bagehot,

Lombard Street: A Description of the Money Market

, New York: Scribner, Armstrong & Co, 1873. Ch. 2, A General View of Lombard St., p. 21-73.

Lecture 17:

Options Markets

Mon, Apr 2

Start Problem Set #5 options

Fabozzi, Ch 10, “Introduction to Nonlinear Payoff Derivatives: Options, Credit Default Swaps, Caps, and Floors;” Ch 28 “The Market for Equity Derivatives”

Shefrin, Hersh, and Meir Statman, “

Behavioral Aspects of the Design and Marketing of Financial Products

,

Financial Management

, 22(2):123-34, 1993.

Lecture 18: Investment Banks, Crowdfunding

Wed, Apr 4

Fabozzi, Ch 7, “Investment Banking Firms.”

Moritz, Alexandra, “

Crowdfunding: A Literature Review and Research Directions

” 2016.

*O. Barr, William M. and John M. Conley,

Fortune and Folly: The Wealth & Power of Institutional Investing

, Business-One Irwin, Homewood Illinois, 1992

Lecture 19: Money Managers, and their Influence

Mon, Apr 9

Fabozzi, Ch 6 “Managers of Collective Investment Vehicles”

*Ellis, Charles,

The Partnership: The Making of Goldman Sachs

, London, Penguin, 2008, Ch 11 Principles. (Reserve Bass)

Lecture 20: Exchanges, Brokers, Dealers, Clearinghouses

Wed, Apr 11

Fabozzi, Ch 18, “The Structure of the Common Stock Market;” Ch 19, “Common Stock Strategies and Trading Arrangements.”

*Commodity Futures Trading Commission and Securities Exchange Commission,

Findings Regarding the Market Events of May 6, 2010

, Report to the Joint Advisory Committee on Emerging Regulatory Issues, Washington DC: U.S. Commodity Futures Trading Commission, September 30, 2010.

Lecture 21: Public Finance

Mon, Apr 16

Fabozzi, Ch 21, “Treasury and Agency Securities Markets; Ch 22, “Municipal Securities Markets”

*Seligman, Edwin R. A.,

The Income Tax: A Study of the History, Theory, and Practice of Income Taxation at Home and Abroad

, 2nd Edition, New York: MacMillan, 1914. Ch. 1, The Development of a Norm of Taxation, p. 3; Ch. 2, Property as a Test of Faculty, p. 6; Ch. 3, Expenditure and Product as Tests of Faculty, p. 10; Ch. 4, Income as a Test of Faculty, pp 15-18; and Ch. 8 The Graduation of Taxation, pp. 29-33.

Lecture 22: Nonprofits, Cooperatives, Philanthropy

Wed, Apr 18

Quincy, Josiah, “Co-operative Societies,”

Christian Union,

January 21, 1880, p. 52 (via

ProQuest

)

Lecture 23:

Finding your Purpose in a World of Financial Capitalism

Mon, Apr 23

Unger, Peter,

Living High and Letting Die: Our Illusion of Innocence

, New York: Oxford University Press, 1996

Sumner, William Graham,

What the Social Classes Owe Each Other

, New York: Harper Brothers, 1883, Ch III, “That It Is Not Wicked to Be Rich,” pp. 43-57.

*O’Hara, Maureen,

Something for Nothing

:

Arbitrage and Ethics on Wall Street

, W. W. Norton, 2016.

Lecture 24: TBD –

Last Class - Review

Wed, Apr 25

《复活》读书简评

作者:时间的朋友 发布时间:2020-03-14 11:32:25

男主人公聂赫留朵夫在读书时接触到了一些先进的思想,并付出了实践,比如将继承父亲的地都分给了农奴,但是正式进入社会后却被拜金享乐等错误思想所影响,并伤害了喀秋莎,身体和精神上的双重伤害。在他担任陪审员后偶遇喀秋莎因卷入一桩谋财害命案件而坐在被告席开始,他的精神复活和罪恶救赎之路便开始了。

整部书写了从贵族等上流社会到平民百姓再到罪犯及革命者的生活现状。最后救出了喀秋莎,自己的灵魂也得以复活。

聂赫留朵夫一直在思考一个问题,那就是造成他所见到的罪恶的原因究竟是什么?我觉得小说最后用宗教教义的形式来解释,并提倡用宗教教义进行自我约束就能达到理想的和平安宁友爱的状态,可能多少还是有点不完美。当然,托尔斯泰在当时的历史条件下,难免有历史局限性,无法提出一个比较好的改良社会制度的方法,这是情有可原的。但是,小说提倡每个人注重自我精神的救赎和复活,强化自我约束以符合互爱的道德标准还是非常值得肯定的。

网站评分

书籍多样性:8分

书籍信息完全性:3分

网站更新速度:7分

使用便利性:3分

书籍清晰度:6分

书籍格式兼容性:5分

是否包含广告:6分

加载速度:6分

安全性:6分

稳定性:6分

搜索功能:4分

下载便捷性:9分

下载点评

- 下载快(517+)

- 愉快的找书体验(172+)

- mobi(567+)

- 体验满分(455+)

- 二星好评(592+)

- 无漏页(294+)

- 傻瓜式服务(422+)

- 少量广告(350+)

- 无水印(600+)

- 无缺页(111+)

- 简单(432+)

- 无盗版(217+)

- 收费(677+)

下载评价

- 网友 孙***夏: ( 2025-01-01 07:07:43 )

中评,比上不足比下有余

- 网友 方***旋: ( 2024-12-14 07:59:50 )

真的很好,里面很多小说都能搜到,但就是收费的太多了

- 网友 汪***豪: ( 2024-12-23 10:25:21 )

太棒了,我想要azw3的都有呀!!!

- 网友 后***之: ( 2024-12-29 05:57:36 )

强烈推荐!无论下载速度还是书籍内容都没话说 真的很良心!

- 网友 訾***晴: ( 2024-12-25 11:21:37 )

挺好的,书籍丰富

- 网友 师***怀: ( 2024-12-31 08:28:34 )

好是好,要是能免费下就好了

- 网友 丁***菱: ( 2024-12-26 16:20:30 )

好好好好好好好好好好好好好好好好好好好好好好好好好

- 网友 冯***卉: ( 2024-12-10 17:58:52 )

听说内置一千多万的书籍,不知道真假的

- 网友 孙***美: ( 2024-12-22 01:37:43 )

加油!支持一下!不错,好用。大家可以去试一下哦

- 网友 石***致: ( 2024-12-14 21:12:11 )

挺实用的,给个赞!希望越来越好,一直支持。

喜欢"Eleven Late String Quartets, Opp. 74, 76 and 77, Complete"的人也看了

- 袁隆平口述自传(20世纪中国科学口述史) pdf mobi txt 2024 电子版 下载

- 假如给我三天光明 pdf mobi txt 2024 电子版 下载

- 自由人生 黑皮阅读 高中课外阅读(胡适在中国近现代学术界,开一代风气之先) pdf mobi txt 2024 电子版 下载

- 有一个男孩爱着那个女孩 pdf mobi txt 2024 电子版 下载

- 牙体解剖与口腔生理学(第2版)/北京大学口腔医学教材 pdf mobi txt 2024 电子版 下载

- 焦虑情绪调节手册[美]大卫·伯恩斯学林出版社【现货实拍 可开发票 下单速发 正版图书】 pdf mobi txt 2024 电子版 下载

- 抱持与解释(一则精神分析的片断)/精神分析经典译丛 pdf mobi txt 2024 电子版 下载

- 高效沟通致富法 pdf mobi txt 2024 电子版 下载

- 2011年全国一级建筑师执业资格考试权威押题密卷.建筑工程管理与实务 pdf mobi txt 2024 电子版 下载

- 最新英语专业考研英语语言学考点测评 pdf mobi txt 2024 电子版 下载

书籍真实打分

故事情节:3分

人物塑造:8分

主题深度:8分

文字风格:5分

语言运用:6分

文笔流畅:3分

思想传递:4分

知识深度:8分

知识广度:4分

实用性:9分

章节划分:4分

结构布局:4分

新颖与独特:5分

情感共鸣:8分

引人入胜:3分

现实相关:4分

沉浸感:6分

事实准确性:4分

文化贡献:3分